What is a bank? Why do we need one?

A bank is a financial institution that allows people to deposit their money securely while also offering other financial services. The most basic of these are Deposits, Loans, Fixed Deposits/Recurring Deposits, Credit/debit/ATM Cards, and investments.

Banks serve everyone, from the public to small businesses to the government. Therefore, we can say that banks are of high importance in helping a nation’s economy. For an individual, having a Bank account can be necessary as most of the financial activities happen through banks these days. More than that, banks allow us to save and grow our money through deposits and investments. Also, Banks provide services like loans, which are really beneficial. Formal Loans are safer and legally protected than informal loans.

Credit unions, on the other hand, are non-profit organisations with their members managing everything. They provide loans at a smaller interest rate as compared to banks. Their services, though, are limited.

How do banks work?

Banks take deposits from their customers and use the same money to provide loans with interest.

Common services offered by a bank

- Accepting Deposits – banks keep our money safe by keeping our deposits. We can withdraw this amount whenever we want.

- Providing Loans – Banks provide loans to people, businesses, and the government for various needs.

- Payment and settlements – Banks facilitate financial transactions by offering services such as credit and debit cards, cheque facilities, and electronic fund transfers.

- Currency exchange – They let us exchange foreign currencies.

- Safekeeping of Valuables – They keep our valuables, like gold or silver, or any other item, safe in a locker.

- Investment Services – banks give us the options to invest in mutual funds, stocks, and bonds. Giving its customer a chance to grow their money.

- Internet Banking Services – Banks offer online banking services, making it super convenient for their customers to make transactions from anywhere.

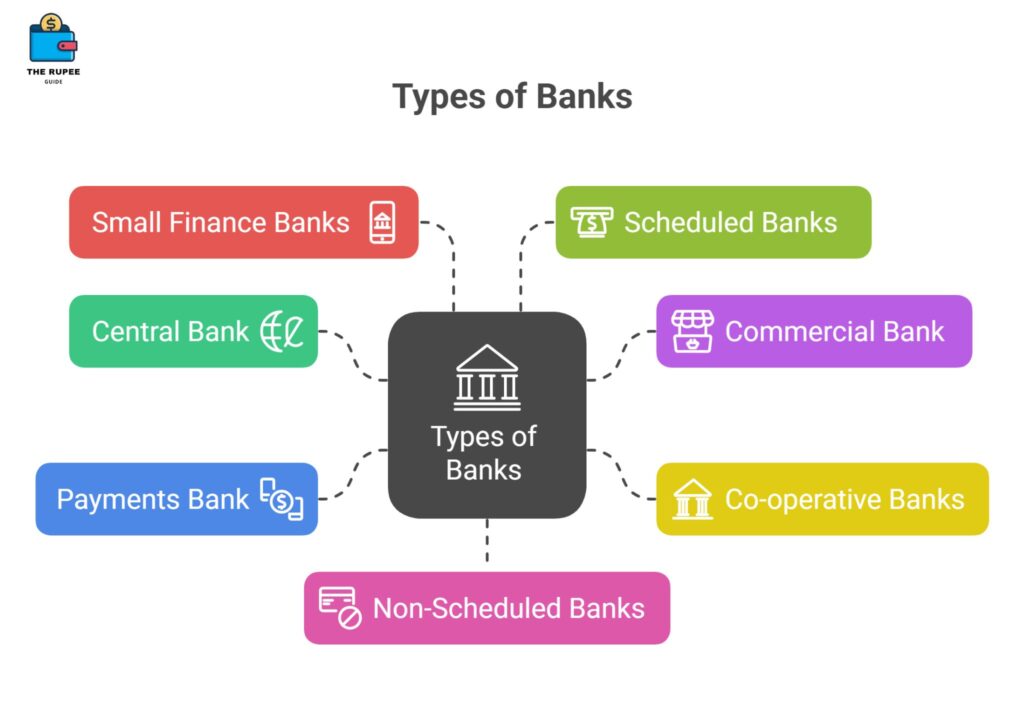

Types of banks

Central Bank

The Reserve Bank of India (RBI) serves as the nation’s central bank and is responsible for regulating and overseeing the monetary and banking system.

Commercial Bank

Commercial banks provide basic banking services to the general public, including individuals and businesses. Traditionally, commercial banks have been physically located where the customers can use the teller windows and automated teller machines. Now, with digital services becoming more and more prevalent, commercial banks have taken almost all of their services online, including deposits, withdrawals, loan applications, applying for credit and debit cards, bill payments, etc.

- Public Sector Banks – PSBs are owned and operated by the government. E.g., Bank of Baroda, Bank of India, Canara Bank, Punjab National Bank, State Bank of India, bank of Maharashtra, Central Bank of India, Punjab and Sind bank, etc.

- Private Sector banks – These are privately owned. E.g., Axis Bank, Bandhan Bank, Dhanlaxmi Bank, HDFC bank, ICICI bank, IndusInd Bank, IDFC bank, IDBI bank, Yes Bank, City union bank, etc.

- Regional Rural Banks – RRBs provide services in rural or semi-urban areas. They can be owned by the Government, Commercial banks, or State Governments. e.g., Andhra Pradesh Grameena Bank, Uttarakhand Gramin Bank, Tamil Nadu Gramin Bank.

- Foreign Banks – They have branches in India, but their headquarters are located in foreign countries. E.g., Bank of America, DNB Bank, HSBC Bank, National Australia Bank, etc.

Co-operative Banks

Co-operative banks are run by an elected managing committee. Co-operative banks must be registered under the Co-operative Societies Act of 1912. They work on a no-profit, no-loss principle. Co-operative banks usually help small businesses or those with self-employment. Co-operative banks can be categorized into State Co-operative banks, Urban Co-operative Bank, Payments banks, Small Finance Banks, etc.

- State Co-operative Bank – It is a federation of the central Co-operative banks that will act as a custodian of the co-operative banking structure in the state. E.g., Delhi State Co-operative Bank, Goa State Co-operative Bank, etc.

- Urban Co-operative Bank – These are primary Co-operative bank located in urban or semi-urban areas.

Payments Bank

Payment banks are a newly introduced banking model in India. They can accept a restricted amount (which is 1 lakh). They offer services such as ATM Cards, Net Banking etc.

Small Finance Banks

They serve the underserved sections of the population, like small businesses and low-income individuals. SFBs are licensed under section 22 of Banking regulation act 1949 and governed by the provisions act of 1934. E.g., Ujjivan Small Finance Bank, Suryoday Small Finance Bank, Jana Small Finance Bank etc.

Scheduled Banks

These banks come under the 2nd Schedule of the RBI Act 1934. They need to have a paid up capital of Rs. 5 Lakh or more.

Non-Scheduled Banks

Local Area banks are not listed in 2nd schedule of RBI Act of 1934.

How to Open a Bank Account

Opening a bank account is a simple process:

- Choose a bank and account type (savings/current).

- Fill out the application form online or offline.

- Submit required documents (Aadhaar, PAN, proof of address, photographs).

- Make the initial deposit as per bank policy.

- Receive your passbook, ATM card, and internet banking details.

Conclusion

Banks are more than just places to keep money. They support savings, provide loans, encourage investments, and promote financial literacy. Modern banking has gone digital, making financial services accessible to almost everyone. Choosing the right bank is important, so customers should always check the terms, schemes, and offers before opening an account. With the presence of different types of banks in India, people can select the one that best fits their needs, ensuring both security and financial growth.

FAQ’s

What is Krushi?

Krushi is a Public Charitable Trust designed to carry out farming on an extensive scale using Natural & Sustainable methods.

How does it work?

Krushi operates by combining traditional farming practices with modern sustainable technologies. This includes eco-friendly techniques like organic farming, crop rotation, and efficient water management

What are the major challenges of current agriculture?

Current agriculture faces challenges like soil degradation, water scarcity, climate change, and overuse of chemical fertilizers and pesticides. These issues threaten long-term productivity and sustainability.

How does Krushi address the above challenges?

Krushi addresses these challenges by promoting sustainable farming techniques, conserving resources, and supporting farmers with training, tools, and eco-friendly practices to ensure long-term agricultural health.