Broke? Here’s How to Make a Budget That Works for You

Intro

Let me start with a question—how many of you have set a goal that involved spending money? Planning a vacation? That’s an expense. Buying that favourite dress? Another expense. Getting into your dream college? Yet again, an expense.

Every year you promise yourself that this is going to be your year – but reality kicks in sooner. You have rent to pay, bills piling up, EMIs to cover, and let’s not forget that birthday treat or the dress you’ve been eyeing for months.

And there it is, cash leaving your wallet, that beep on the card machine, the broken piggy bank in the dustbin.

Budgeting exists at different levels—national budgets (Nirmala Sitharaman popping into your head), event budgets (think school or society events), and personal budgets, which help you manage daily expenses. Today, we’re focusing on What is budgeting, Why you need it, and How to make a personal budget.

What is Budgeting?

Budgeting is not just about spending wisely. And it’s definitely not a magic potion to vanish all your debts and spending.

Budgeting is a concept of financial literacy. A budget is a financial plan that helps you manage your money.

At a household level,

Budgeting helps you understand your income (the money you earn) and expenses (essential costs like rent, bills, food, and groceries). It also guides you in managing the leftover money—whether to invest, save, or buy insurance—so you can make informed financial decisions.

Then we come to the next important question,

Why do I need a budget at all?

Regardless if you have generational wealth or you are hardly making ends, budgeting and saving in the long-term can save you from overspending, running out of money, and other financial crises like medical emergencies or the lockdown (iykyk).

Budgeting can help you prioritize your expenses accordingly. Of course, you won’t be able to buy everything that you need or want.

Budgeting can help you set and achieve goals. For example, if you want to take your family on a vacation, now a budget will help you plan how much you can save each month for it and how much time it will take. Budgeting also helps you identify areas where you can cut expenses and save more effectively. (adjust your spending habits)

Get out of or save yourself from debt

Debt is the money you owe from somebody. Debt can be good (education loan) and bad (buying a luxury item), formal (bank loans) or informal (money owned from your friend e.g.).Debt can become a burden, leading to stress, conflicts with family and friends, anxiety, and a reduced income due to interest payments. Being unable to pay your debt on time can harm your credit score.

Budgeting gives you control over your finances, allowing you to allocate your money wisely across different expenses and priorities.

Let’s talk about how to make a budget

How to Start Budgeting?

If you are just starting out, budgeting doesn’t have to be complicated at all.

You can start budgeting with a pen and paper. Use free printable budget sheets, or create a custom spreadsheet in Excel or Google Sheets for flexibility. Budgeting apps also offer automation by linking to your bank account.

It is totally up to you.

While budgeting you may ask yourself the following questions:

- What are my long-term (e.g. buying a house, saving for education) and short term goals (e.g. buying new furniture, paying back a friend)

- What are my Needs and Wants? This also involves learning How to track spending.

- What is my total income, how much have I been spending and what are my savings?

Needs are the things that you need to survive, they cannot be ignored. Like you need groceries, you need to pay your house rent, course fee and electricity and gas bill etc.

Wants are the things that you wish to have but don’t need for survival. Wants are not necessarily a bad thing. When you keep a balance between your needs and wants and savings, you are hitting the right equilibrium. Wants can look like buying an expensive car, eating at a restaurant, or going for a movie or vacation.

So, how to make a budget – like exactly?

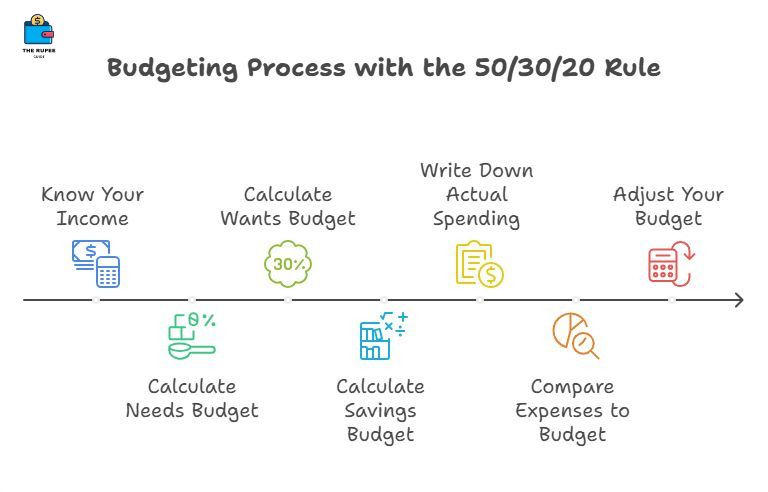

A simple approach is the 50:30:20 rule—allocate 50% to needs, 30% to wants, and 20% to savings. Adjust needs and savings as required, but avoid increasing spending on wants. Let’s discuss this in detail.

The Classic 50/30/20 rule for budgeting

- Know Your Income – Determine your total monthly income after taxes.

- Calculate Your Needs Budget – Allocate 50% of your income to essentials like rent, groceries, debt, utilities, and transportation.

- Calculate Your Wants Budget – Set aside 30% for non-essential expenses like dining out, entertainment, and shopping.

- Calculate Your Savings Budget – Reserve 20% for savings or investments.

- Write Down Your Actual Spending – Track all your expenses to see where your money goes.

- Compare Your Expenses to Your Budget – Check if you’re overspending or underspending in any category.

- Adjust Your Budget – Make necessary changes to align your spending with financial goals.

Common Budgeting Mistakes to avoid

The term ‘budget’ may ring a bell of stress and deprivation in your mind but budgeting is actually an important step towards your financial well-being.

Not Tracking your spending

Tracking your spending is just as important as planning how much to spend.

Guessing costs

Expenses like mortgages and bills are somehow fixed and do not change over the long-term but groceries, clothes and postpaid phone bills can vary. Do not just guess the amount of these variable expenses but tally the amount spent by going through receipts and transactions from previous months.

Making a budget can feel like a chore, tempting you to just second guess these things, But doing so will leave little scope for more accurate spending. Sometimes you may not have a receipt or anything to note down, so just simply try to write down somewhere how much you spent on one thing. Calculating the actual spending can help you predict better for the coming month. Second guessing can lead to overspending.

Leaving out expenses

Some expenses occur annually, like car registration or festival celebrations, while others pop up occasionally, such as birthdays or social gatherings. These may seem small individually but can add up, so it’s important to account for them in your budget.

While you may feel safe or feel that they are irrelevant, last minute spending can create a hole in your budget or may force you to borrow money. Save a little amount each month for these expenses and use them wisely when the time comes.

Examples of irregular expenses

- Car registration

- Insurance premiums

- Property tax

- School fees

- Holiday travel

- Birthday gifts

- Weddings

Leaving savings out

Savings can be hard when you are living on hard ends but not saving anything at all will only prove fatal to you in the long-term. Save as consistently and as little you can start from and slowly build up from that. Try the 50/30/20 rule.

It is critical that you save for any emergency. Rule of thumbs says that you should atleast have emergency funds equivalent to 5-6 months of income. Start with a smaller goal if this seems overwhelming.

Being overly strict

It is normal to be a little flexible with your budget if you are going through a financial crisis or living beyond your means. ‘Making and executing a budget’ should not translate “taking away all the joys and colors” but “Being disciplined and Mature while spending on little pleasures of life”. Being too strict with your budget can also make you lose motivation faster. Set realistic goals.

Plan around Gross pay

making a budget out of your net income can lead you to assign more to different categories than you actually will have. Instead have a budget around your gross pay, your income after paying off the taxes.

Not working as a team

If you have an earning buddy, be it your spouse, sibling or your parent, team up for shared goals. Communicate often. Working together will give you the opportunity to grow faster.

Adjust your budget over time

There will come various phases in your life, like maybe you have to move to another apartment with different rent, or you have a new addition in the family, there may be a medical emergency that needs your attention. It is not sensible to stick to the same budget, you have to plan it again when the time comes.

Assignments

Assignment 1: Calculate Your Fixed Expenses

Make a list of all your fixed monthly expenses, such as mobile recharge, electricity bills, rent, loan EMIs, subscriptions, and any other payments that remain consistent each month. Add them up to get the total amount you need to set aside every month.

Assignment 2: Track Your Weekly Spending

For the past seven days, note down everything you’ve spent money on—whether it was groceries, transport, eating out, shopping, or any other expense. Categorize your expenses and add up the total amount spent during the week.

Conclusion

Budgeting is not just about limiting expenses—it’s about gaining control over your finances and making informed decisions for a secure future. A well-planned budget helps you prioritize spending, avoid debt, and build savings for both short-term goals and long-term financial stability. While sticking to a financial budget may seem challenging at first, developing the right mindset and staying consistent can lead to financial freedom. Start small, stay flexible, and remember—budgeting is a tool to empower you, not restrict you.

The budget is not just a collection of numbers, but an expression of our values and aspirations. – Jack Lew

Also Check this:

- What is investing

- How to manage money

- How to stop living paycheck to paycheck

- What are the different types of banks

FAQs

How to cut unnecessary expenses?

Cutting unnecessary expenses can look difficult at first but is really important. Firstly, you need to have a fair idea of your expenses, where you are actually spending money. You can then see what expenses you really don’t need to make. This can be buying something you don’t need, spending mindfully, and finding alternate routes to purchases like borrowing if you don’t need the thing for a long time.

What is the 50:30:20 rule for budgeting?

The 50:30:20 rules gives a person an ideal ratio for spending on needs, wants and saving. If a person earns 10k, then she ought to spend 50% i.e. 5k on her needs, 30% i.e. 3k on wants, and 2k she should save. It doesn’t have to be strictly this ratio and can change depending on the needs of an individual. Similar to this, there is also a 70:20:10 rule and 40:30:30 rule.

Why is budgeting important?

Budgeting helps you take control of your finances, allows you to save and invest, manage debt, encourages better decision-making, reduces stress and most of all, prepares you for emergencies.

What are some best budgeting apps?

How to create a personal budget?

As a beginner, you can start with some simple steps like tracking your spending and listing down your needs and wants. After that depending on your income, you can allocate a sum to different brackets, like Rent, EMIs, grocery, memberships, transportation, shopping entertainment etc.

Such a great blog, and your explanation on how to start budgeting is also helpful for me. Thanks for sharing with us.

Thanks, Radhika, for your words of appreciation.