Living Paycheck to Paycheck refers to being in a situation where you are totally reliant on your monthly salary to fulfill expenses. This means that the person is dependent on his employment status to meet the financial obligations. It generally consists of having limited to no savings and the expenses exceeding the inflow. Living in this phase makes the person highly prone to financial crisis due to emergencies. (getting laid off, disability, losing source of income, addition of new expenses, medical urgency).

Most People who live paycheck to paycheck fall in the category of working poor; but this can be inaccurate as working poor are identified as people with income below the poverty level. In the case of income level, exceptions can be made for middle or high income levels as well. People living paycheck to paycheck, often have a limited set of skills but again, those with advanced skills or degrees can also have a hard time making ends meet. The majority work two jobs to meet their needs. Most of these people don’t know how to get out of living paycheck to paycheck or have poor financial planning.

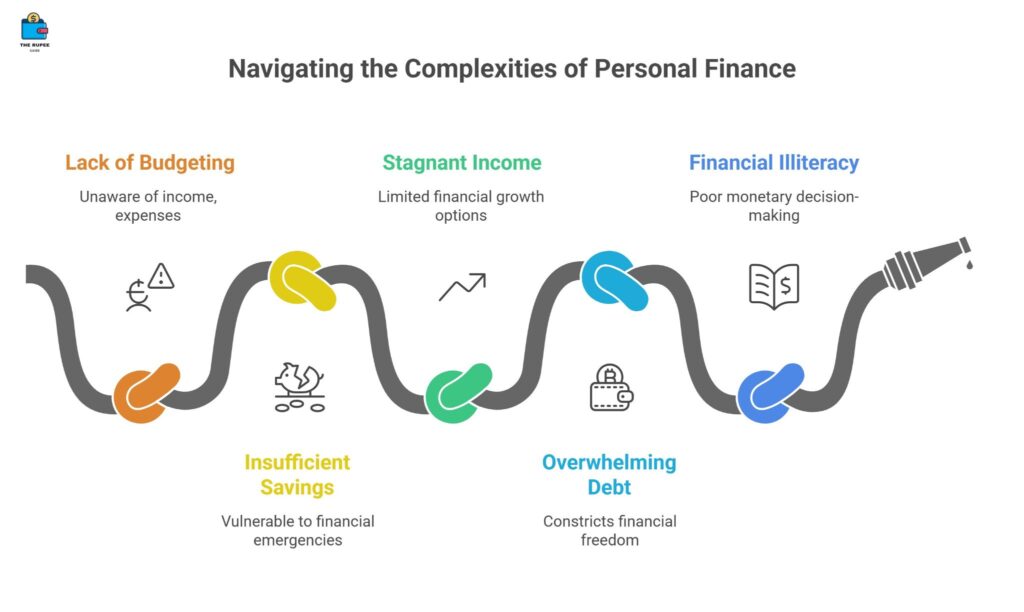

Why do people live paycheck to paycheck?

Living with feeble savings can be a result of various factors

- Earning significantly low, for e.g. working poor. Knowing a skill not much in demand in the market or having limited knowledge.

- Earning the same over years, not allowing the person to keep up with the rising cost of living i.e. inflation.

- Accumulating Debt (identify the stats for india)

- Financial Emergency like losing a job, medical urgency, addition of a new expense (having a baby), being disabled after an accident etc.

- Poor Financial Literacy, impulsive spending, inability to live below your means

How to stop living Paycheck to Paycheck?

A 2025 report by ADP Research Institute suggested that almost 57% of the workers globally are living paycheck to paycheck, while 23% are juggling multiple jobs to make ends meet. It is important for anyone to take a step forward and start planning ahead of time on how to get out of the situation. Here are some tips;

Start Budgeting

Knowing how to make a budget is the first vital step of financial planning. Budgeting allows you to have an accurate understanding of your inflow and outflow. Knowing where your money is going will help you to identify places to cut down expenses. You need to alter your spending habits.

Don’t know how to make a budget that just works? Check out our Budgeting guide.

For Instance, there could be memberships and subscriptions that you are not using and can still do without, or maybe you can ditch transportation for some shorter distances, cooking at home instead of ordering/eating out, find the best deals for buying stuff you really need, go for second hand, cut down on credit card expenses etc.

Save

Cut down anywhere you can, no matter how small the amount you are saving. Small steps can lead a long way with patience. Living without savings is highly risky, as any emergency can lead to debt or financial crisis. Consider saving in an account with better interest rates than traditional saving or checking accounts. Check different rates of interest for different types of savings accounts here. You can even automate savings, so it gets cut as soon as your paycheck is there. Convert from high interest rate credit cards to low interest rate credit cards. Finally, slowly but steady, Learn How to build an emergency fund covering from 1 month to 6 months of expenses.

Check Saving Schemes offered by banks here;

Increase your Income

Work on a side hustle, a part time or become a gig worker if possible. You can also work extra shifts for overtime payment. See if any of your family members can start earning, for e.g. Someone in the 8th or 9th standard can teach junior classes 3 days a week.

Pay off debt

Living paycheck to paycheck can often lead you to take small to big loans to cover needs and emergencies. It can also force you to exploit your credit card, building up unnecessary debt. Prioritize your debt payment above everything, try the debt snowball strategy to pay debt off. In some parts, debt consolidation loans are being offered. At the same time, avoid accumulating any more debt. If you still need to borrow, try to take the one with lowest interest possible. Once debt is cleared, it gives you more clarity and allows you to invest in things like retirement plans and education.

Become Financially Literate

Sometimes even a high paying job cannot help you get out of a crisis, if you do not know what to exactly do with the money in your pocket. With inflation and growing needs, financial literacy becomes the need of the hour. Be a mindful consumer, learn investing and saving, have a budget, know your needs and wants.

Conclusion

Paycheck to paycheck cycle can take a toll on your financial health. In the long run, it can affect other aspects of your life as well, like physical and mental health. Thus, it becomes important to get out of the cycle as soon as you can.